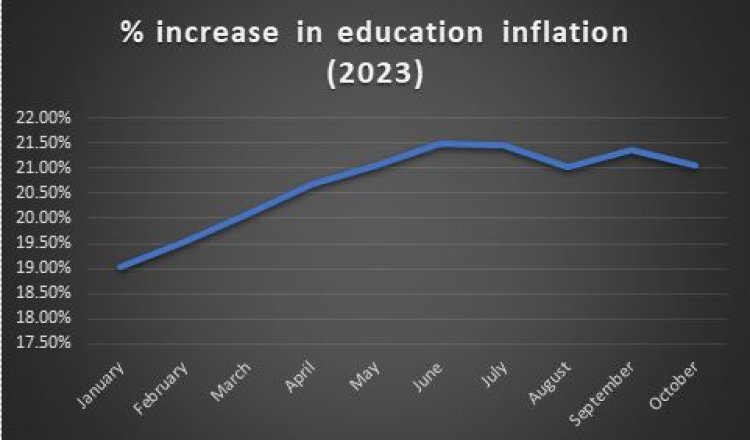

Schools Pay 42% More Taxes by Q3 Amid Concerns Over High Cost of Education in Nigeria

Educational institutions in Nigeria paid 42% more taxes by the third quarter of 2023 based on a quarter-by-quarter analysis of data from the National Bureau of Statistics (NBS), amid concerns over the rising cost of education in the country.

Educational institutions in Nigeria paid 42% more taxes by the third quarter of 2023 based on a quarter-by-quarter analysis of data from the National Bureau of Statistics (NBS), amid concerns over the rising cost of education in the country, which can worsen the number of out-of-school children in Nigeria.

The analysis by Nairametrics includes Value Added Tax (VAT) and Company Income Tax (CIT). A total of N13.82 billion in taxes were paid by institutions in the education sector by Q3 2023, which was a 42% increase when compared to the N9.76 billion paid by Q2 2023.

Year-on-year, there was an increase of 34% from the N10.3 billion recorded in the third quarter of the previous year.

Read Also: Private Schools Association Appeals to Anambra State Government for Tax Relief

The analysis shows that the increase in taxes is more pronounced for CIT than for VAT.

According to the Federal Inland Revenue Service (FIRS), CIT is a 30% tax imposed on the profit of companies and VAT is a 7.5% consumption tax paid when goods are purchased, and services rendered and borne by the final consumer.

FIRS collected N6.82 billion as VAT from institutions in the educational sector by Q3 2023, which was an increase of 26.92% from the N5.38 billion collected in the previous quarter.

The amount collected in Q3 2023 was also an increase of 26.31% from the N5.4 billion collected in the same quarter of the previous year. Therefore VAT made up 49% of the taxes FIRS collected from educational institutions by Q3 2024. The rest was CIT, which recorded the most increase.

Nnenna Orji

Nnenna Orji