12 Key Features of Nigeria's Newly Implemented Student Loan Scheme

These amendments aim to enhance accessibility to higher education and alleviate financial burdens on students, contributing to the overall development of Nigeria's education sector.

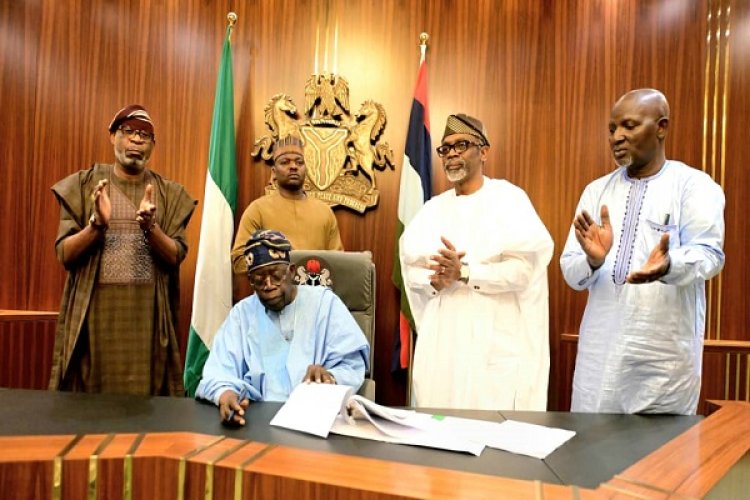

President Bola Ahmed Tinubu has officially signed the student loans amendment bill into law at the State House on Wednesday, April 3. The bill, also known as the Students Loan Law, introduces significant changes to Nigeria's student loan scheme. Notable among these changes is the establishment of the Nigerian Education Loan Fund, tasked with overseeing all loan requests, grants, disbursements, and recovery processes.

Here are 12 key highlights of the amended student loan scheme:

1.Interest-Free Loans:Nigeria's student loans are now interest-free, providing relief to borrowers.

2.Static Sum with Flexible Repayment Options:The loan amount remains static, with various repayment options tied to the borrower's income.

3.Grace Period: Beneficiaries will enjoy a two-year grace period after completing their one-year National Youth Service before commencing loan repayment.

READ ALSO:Tinubu Signs National Student Loans Amendment Bill into Law

4.Income-Linked Repayment:Repayment begins only when the beneficiary starts earning income, with the baseline repayment set at 10% of monthly net pay for employees or 10% of monthly income or profit for self-employed individuals.

5.Repayment Models: Borrowers have the option of choosing between a one-off repayment or indicating a particular percentage model, particularly beneficial for those in private businesses.

6.Employment Reporting:Beneficiaries unable to secure employment within the grace period must periodically report their employment status to the Student Loan Board.

7.Waivers for Special Cases:Waivers will be granted to beneficiaries confirmed to be deceased, terminally ill, or incapable of earning a living through work.

8.Funding Sources:The Act outlines various funding sources, including a percentage of federal government profits from oil and minerals, taxes, levies, duties, education bonds, and endowment fund schemes.

9.Centralized Management:The Nigerian Education Loan Fund will be domiciled in the Central Bank of Nigeria (CBN) and managed by an 11-person special committee chaired by the CBN governor.

10.Application Process:Candidates must submit loan applications to the committee chairperson through their respective banks, accompanied by a cover letter signed by the head of their institutions.

INCASE YOU MISSED:100 Undergraduates Awarded N60m Scholarship by WACT, Onne

11.Committee Composition:The special committee overseeing the fund consists of 11 members, with the CBN governor serving as chairperson.

12.Institutional Support: To apply for the education loan, applicants must obtain endorsement from their respective institution heads and student affairs officers.

These amendments aim to enhance accessibility to higher education and alleviate financial burdens on students, contributing to the overall development of Nigeria's education sector.