Experts Examine Impact of Nigeria’s New Tax Regime on Real Estate Sector at FUTA Seminar

Experts in finance, taxation, and real estate have identified Nigeria’s new tax regime as a major turning point for the country’s property market, urging stakeholders to adapt quickly to its structural and compliance-driven demands.

Experts in finance, taxation, and real estate have identified Nigeria’s new tax regime as a major turning point for the country’s property market, urging stakeholders to adapt quickly to its structural and compliance-driven demands.

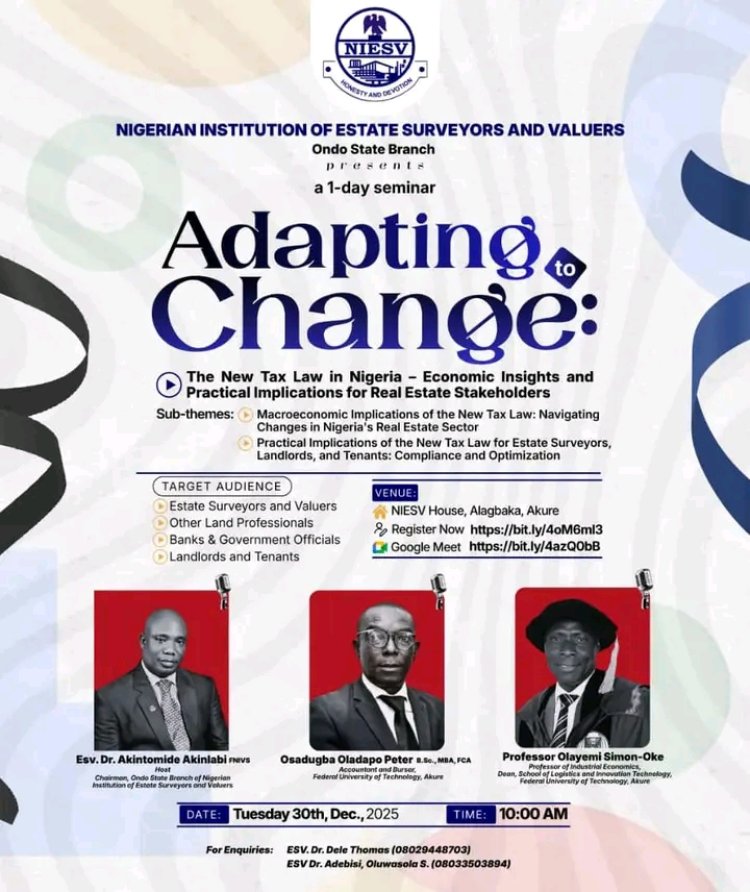

This position was articulated at a seminar organised by the Nigerian Institution of Estate Surveyors and Valuers (NIESV), Ondo State Branch, held at the Federal University of Technology, Akure (FUTA). The seminar was themed “Adapting to Change: The New Tax Law in Nigeria – Economic Insights and Practical Implications for Real Estate Stakeholders.”

Speaking at the event, the Bursar of FUTA, Mr. Peter Osadugba, described the Nigeria Tax Reform Act as the most significant shift in the nation’s fiscal framework in recent times, with far-reaching implications for estate surveyors, landlords, tenants, developers, and investors.

According to him, the new law introduces comprehensive reforms affecting rental income, property sales, stamp duties, capital gains, and value-added tax, all now consolidated under a single legal framework for the first time. He highlighted key provisions of the reform, including rent relief, VAT exemption on residential properties, withholding tax exemptions on Real Estate Investment Trusts (REITs), regulated capital gains on property sales, stricter enforcement of stamp duties and lease compliance, and incentives for mortgage financing.

“These changes are designed to simplify taxation, encourage home ownership, and stimulate investment in Nigeria’s property market,” Osadugba said.

He stressed that proper documentation is now central to compliance, noting that tenants seeking rent relief must provide verifiable evidence such as receipts, bank transfer records, or signed lease agreements stating annual rent payments. He added that employees are required to notify their employers and submit supporting documents for rent relief to be reflected in PAYE tax computations.

Osadugba further explained that the reforms increase landlords’ exposure to taxation, as rental income now forms part of total taxable income, potentially raising overall tax liabilities depending on applicable marginal rates.

Also speaking, the Dean of the School of Logistics and Information Technology (SLIT), FUTA, Professor Olayemi Simon-Oke, described the Nigeria Tax Act 2025 as the beginning of a new era for the real estate sector. He said the reforms are expected to eliminate double taxation, promote mortgage uptake, formalise rental transactions, and improve transparency across property dealings.

Professor Simon-Oke noted that the reforms would enhance data availability for valuation and market analysis, boost investor confidence—particularly among institutional and foreign investors—and support housing finance growth. He added that the reforms would also generate additional revenue for government, strengthen fiscal stability, reduce dependence on oil revenues, and create jobs across the real estate value chain.

While acknowledging the opportunities presented by the reforms, he cautioned that they also introduce risks if poorly implemented. He urged stakeholders to embrace proper documentation, professional advisory services, transparent lease and sale structures, and long-term strategic planning. He also called on policymakers and regulators to ensure clarity in implementation, strengthen enforcement, and support capacity building to prevent the emergence of a dual informal-formal real estate market.

“If properly navigated, the new tax regime can catalyse a more mature, stable, inclusive, and growth-oriented real estate market that meaningfully contributes to Nigeria’s macroeconomic stability and housing needs,” he said.

Earlier, in his keynote address, the Chairman of NIESV, Ondo State Branch, ESV Dr. Akintomide Akinlabi, urged stakeholders to proactively adjust their strategies in response to the new tax framework. He described the real estate sector as a critical driver of economic growth and national development, noting that the new law would significantly influence profit margins, investment decisions, and the future structure of the property market.

“The theme of this seminar is a call to action for developers, investors, estate surveyors and valuers, and policymakers,” Akinlabi said. “The new tax law introduces variables that will redefine the real estate landscape in Nigeria, and adaptation is no longer optional.”